AJaGi~

AJaGi~

by AjaGi~

“OH NO! ETERNITY LEAVE!”

I read this statement somewhere several months ago (source unknown) and thought, so true! However, we just do not seem to think about our jobs in this way. There is a tendency to think that if we just get into the “right” company we will be secure. When, in fact, the truth of it is there is no security (in most positions, with most organizations).

If you are working in private industry, it is likely that your position is “At Will” which essentially says the company doesn’t really need a reason to let you go. Even if you have a union or government position, it may take a little longer, there may be a few more hoops for the organization you call home to jump through but you can be let go. Years ago, our grandparents and parents stayed with their employers for 20 to 30 years and then retired. However, you do not see so much of that anymore and even if we did, I don’t think that it would really make a difference.

By make a difference I mean to say that even if you land your dream job with the dream company right out of school and stay there until you are 45 or 50, you still need a plan for the next phase of your life. I believe that next phase or even perhaps the first phase, if you are so positioned, is to start a business.

Let’s face it, your firm may be ready for you to retire at age 45 or 50 but most of us are nowhere near ready at that point. Not that we might not like to cut back some, most of us just are not prepared financially to do so. In fact, there is still another 15 to 20 years! before you can even apply for your retirement benefits. Also, at 45, those benefits are not likely to take you very far into your golden years but that, let’s face it, is not their concern. It’s up to you to figure out how you’re going to survive on the planet for, at least, 20 more years (until 65), not to mention 10 to 30 more years into your 70’s, 80’s, even 90’s.

Recently, we all have had reason to think about and to consider the potential devastation a large corporation can have on the economy. Think auto industry, Enron, heck Bernie Madoff, even! Now, consider particularly those individuals who were just about to or had just retired from these organizations and had their 401k’s largely invested with or in their companies. How do they start all over at 65? They don’t, I suspect.

Now, it is not my intention to beat up on corporate America. I’ve made my way thus far working in corporate America. I raised a child (pre-school, private school, College, before school care, after school care, summer programs, swimming, soccer, basketball, t-ball, softball, little league, music lessons, band, orchestra, choir, drama, oy vey….., bought a home, several cars, etc. You all know, just running on my little tippy toes, trying to make it all happen. Right?

In all fairness, my corporate America income allowed me to accomplish as much as I did. However, it is also my corporate America career that helped me perfect my multi-tasking skills, become intimately familiar with the all-nighter, function on little to no sleep, get rid of the need to wear anything other than blue or black suits with matching blue or black pumps and to jump, skip, hop, turn, twist, bend and stop on a dime. Tada!

Some in smaller companies I’ve worked in wondered why the need to document so thoroughly when they saw no reason to. Living inside Corporate America people! Major rule if not the first rule – C.O.A., Cover Your Assets! That’s not necessarily an accounting rule. This has saved my little assets on more than one occasion over the years. I’m tempted to quote examples but probably best that I don’t.

However, again, in all fairness, the goal of a corporation is to make a profit and the animal will do what is its nature to do! I don’t know about you but I wish I had bought stock in

Microsoft,

Bill Gates, Microsoft Founder

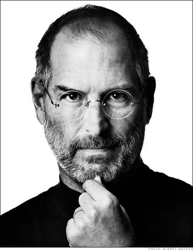

Apple,

Steve Jobs Apple Founder

Google,

Larry Page Google Co-Founder

Sergey Brin Google Co-Founder

Pepsi,

Donald Kendall PepsiCo Founder

Coke,

Doc (John) Pemberton – Coca-Cola Founder

Rex Tillerson Exxon CEO

Exxon

even, to name a few. Better yet, wish someone had bought me a share or two when I was a kid! So, I’m not angry about the Corporate model, I get it, I think anyway. Corporate America can be, should be, if nothing else, a great training ground. For the most part, I enjoyed my stay and would consider going again for the right…well, everything. 🙂 However, here and there, every now and then, we need to be concerned about who is in charge.

So, what I’m getting at is the small business. The large corporate conglomerates seem to get all the attention but it is the small business that keeps America’s economy moving along. Per the SBA, small businesses make up 99.7% of all employER businesses in America! Employ about half of all private sector employees, pay 43 percent of total U.S. private payroll and have generated 65 percent of net new jobs over the past 17 years. That’s significant, Y’ALL.

HEALTH CARE

(Slipping sideways for a moment – but to a point)

I really have a hard time understanding how anyone in America could argue against the need to “fix” health care in this country. This is not a political statement, this is a dollars and sense statement, at least it is in my head. However, before I move to the dollars and sense of it, as I see it, let me just ask this. Have you ever had to fix something that was broken? When you got it “moving” again was it exactly as it should be or could be OR did you have to do a little more work on it, tweak it, if you will.

Let’s start somewhere with the health care fix, we can tweak, enhance, correct, add, eliminate as we start moving in a new direction. Anyway, what is needed and how to proceed can start to become clearer when we are moving rather than sitting and spinning in the same place.

So, what I think I know about health care from being a part of the purchasing, negotiating, budgeting process from inside Finance & Accounting departments is this. The cost of health care has gone up approximately 10% every year since the 1980’s. Now, 7, 8, 9, 10, 11, 12% outpaced my income increases in most years. How about yours? I have been the one trying to tweak a budget so that the company could continue to absorb the bulk of health care expense and not pass it along to its employees. I’ve also had my health care contribution raised so much one year that it more than cancelled out my “exceptional performance” raise that year.

Then there is Medicare, which I admittedly don’t know enough about except that it seems to be a well-known fact that it is laden with fraud related issues. I hope that isn’t true but if so, I would say – policy & procedures, mandated Internal controls and regular site audits should be a good start but I just can’t image that those things aren’t already in place.

What I do know is that seniors in this country are too often faced with outrageous monthly medical costs that cause them to choose between eating and medicine. (Three, four, five hundred dollars a month!) Come On!

COBRA. COBRA is great, I’ve used and appreciated it more than once in the past. However, it is not the whole answer, we need to keep going, keep tweaking if you will, because, unless you have a lot of cash set aside, COBRA is of no use to you.

Now, here is what my reality has been more often than not, money – no time, time – no money. How about you? If I have time, I most likely have no job, if I have no job, then I probably can’t afford COBRA, at least not for long. If you have no job because you are being treated for a medical condition, well, that really would be a major conundrum for most, I think, since currently, no job tends to equate to no health insurance. Who pays then?

Beyond, our seniors, who have suffered with health care dilemmas for some time now, currently, many of our citizens are without any type of health care due to the continued severely high underemployed and unemployment rates throughout this country. In case you don’t know, as of September 2012 the unemployment rate is 11.8% in Nevada, 9.3% in Michigan, 10.2% in California, 10.5% in Rhode Island, 9.8% and in New Jersey. Moreover, what about those who have given up or are now virtually unemployable, due to age, due to no address, no phone service, ultimate health related issues, etc…? Who is counting them? Think that has nothing to do with you, think again.

A couple points, when the healthy can’t get preventive care, they become the unhealthy, when the unhealthy or injured don’t have health insurance they become emergency room only visitors, the most expensive care there is, I suspect. Who pays for that? Why everybody does!

So, in my, admittedly simple logic, because I like to find the simplistic thread that runs through everything. It isn’t reasonable to think that if virtually every American had access to preventive care, job or not, that the cost of health care wouldn’t eventually come down. Arguably, substantially, unless we forget to put the brakes on those who abuse the system.

Now, while this writer is not advocating for or against government health care, heck, no one really ever likes the big brother approach, I think that people just concede to it at times as necessary. Let’s remember that the animal will do what is its nature to do. So, when we privatize where human well-being is the primary concern, we become open to the corporate CEO whose eye is on the bottom line only, as this is what he / she was hired to do, thus humane consideration can become lost in the mix, if not careful.

As example, back in the day, when some HMO’s insisted all should use the exact same brand of a medication, simply because it was most cost effective for the corporation, albeit, a small percentage of its human customers were negatively sensitive or insensitive even, to it. (So sad, too bad for you) Something to be mindful of on the issue of privatization, in my opinion.

On the other side, I wonder what could happen if we had more of the extreme business savvy techniques that streamline and perfect a process in a well run corporation, to all but severely hinder if not virtually eliminate things like, redundancies and other wasteful endeavors in a process. The truly successful organizations, know where all their pennies are and they run like well-oiled machines, constantly reviewing and tweaking, is my opinion. They do this because their existence depends on it, they must perform at optimum capacity for their shareholders, their owners.

Well, in a government run program, we are the shareholders. A government would put all those nice bottom line profits back into this society. I’m not advocating socialism or a dictatorship, just wondering what if government borrowed and adapted a few more business savvy techniques, not to the detriment of the human condition, mind you, if we might be able to get a better handle on things like Medicare and social security. After all, non-profits are corporations too; they need to have a positive bottom line also. It’s just a matter of what they do with the profits. Just a thought. (And please don’t accuse me of implying that our government officials are less than smart or capable, I don’t feel that way at all.)

Nevertheless, I can’t image any of the corporate big boys (and girls –’cause girls kick but too!) to have not gotten a handle on whatever really ails Medicare, for example, since their jobs, if not their careers would depend on it. Sounds like I’m advocating for privatization? Well I’m not, but why reinvent the wheel when there are usually examples and samples to be borrowed and tweaked?

But hey, I could be wrong, have been wrong in the past and will be again!

Bottomline, we all need health care, no matter what our state of employment is AND we all need a pension plan. I hope I’m wrong on this, but I expect that the next generation or two will be ill prepared financially to retire due to the Great Recession and the defined contribution type retirement plans in general (401K type plans). If I am correct, it may be our next big crisis. Let’s hope I’m wrong this time.

SMALL BUSINESS

Did you know that a small business, can setup and offer to its employees both pension plans, like a 401K type retirement plan or at least similar and a health insurance plan? I know, I know, I hear you stating the political arguments; it’s too expensive, too big of a hardship on the small business to provide those types of benefits to their employees. I say two things, first not necessarily and second, maybe, just maybe we should be thinking about it the following way, until all are on board and it is the new normal: If you can’t afford to offer these benefits (within a reasonable timeframe of opening your doors) then you aren’t ready to be in business. I know that sounds harsh but I liken it to eating in restaurants, that saying goes: If you can’t afford to tip, you can’t afford to eat out. (At least, not dining in – go through the drive through). It’s just not fair to the wait staff who work as hard as any of us do for their money and who depend largely on tips to make their pay work for them at all.

So, when you consider the vast number and segments of the population who work as hard as anyone else does in this country, yet who can’t afford health care, is this really how it should be? Also, when so many people don’t have health care, everyone pays, and at a premium when they do need something. Even the healthiest twenty something may have an accident and need medical care, then what?

Now, consider this, when you start your own business, in the beginning it may be only you or you and just one or two others. No matter when you add others to your business or maybe just contract to do business with them, they are very likely to be friends, family and extended family.

So, just to bring my points around, let’s say you have a business and you employ your spouse and your sibling(s) and your Mom and your best friend’s son, who is having difficulty finding employment in the current market. Well, look you now have an opportunity to train people into positions that they might not otherwise have an opportunity to get. Most large or larger corporations are not likely to train someone off the street into a position, they want you to come in with what they want. Moreover, while you will want the same and sometimes need the same, you can afford opportunities to those who just have not had the same opportunities that many of us have had.

The same can be true with health care. However, I want to be clear, in no way am I suggesting that any of us should hire friends and family, just because they are friends and family into positions for which they are not suited or properly prepared. So, don’t get ahead of yourself. This practice is likely to be detrimental, thus taking you all down, you, the business, them and that is not the goal at all. Maybe establish a tuition reimbursement program, done properly, it could be a valid business expense of your organization.

While we all know that healthcare is terribly expensive for everyone, companies included, you may not know that it is a bit different from the company side of things. Now, of course, as with most everything else, the larger organizations have more options and flexibility because, well because they have more resources but that doesn’t mean that the smaller ones are completely out of this game if they want to be in it.

When you buy healthcare as an employer it is a bit like ordering from a smorgasbord. You shop different plans and you pick which services and what levels you want. You have an opportunity to tailor the plan you choose to your current workforce, who can come on the plan and when, deductibles and how much or not, etc.

Of course, because you are small, it will cost you more than larger companies since they can offer more people to a plan but the more you grow the better the rates get. Also, if you, the business can swing it so that your employees have some type of a health plan even if not the best or all that they / you would like, some health coverage is better any day than no health coverage at all. So, you add a health plan and initially your employees have to pay a larger contribution than anyone would like. However, your employer group plan is still most likely less than it would be if they had to pay for an individual plan.

PENSION PLAN

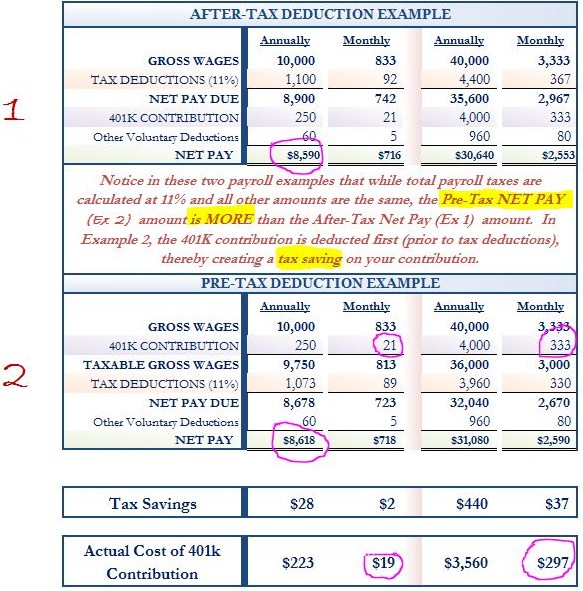

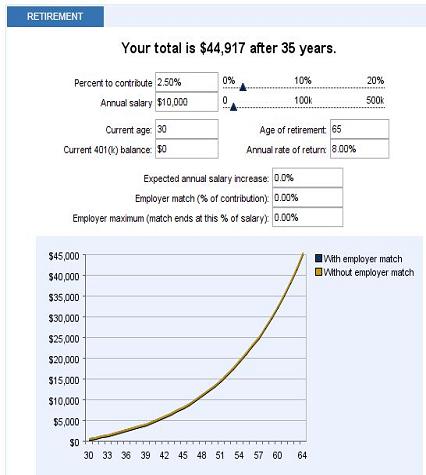

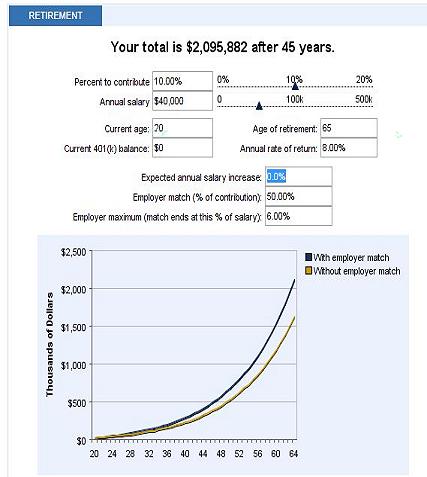

Similarly, a pension plan is not terribly expensive for an employer to set up. They can also decide some things about the plan towards making it doable or not. For instance, we love when an employer matches our 401k contributions, but they don’t have to. So, even if our employer doesn’t offer a match right away, we still have a pension plan that we can pay into in whatever tax deferred, payroll deducted increments we like, for the most part. Even a little starts to add up eventually, especially when you start young. However, young, old, somewhere in between, don’t let that get in your way. Who knows how long you may need to survive without active income down the road?

Additionally, just because a company can’t or doesn’t commit to matching your contributions as you make them throughout the year, doesn’t mean that they cannot elect to make a contribution, say at the end of the year once they see their final bottom line.

I once worked for an organization who gave out bonuses once a year if the profit margin was over a certain percent. Anything over the designated percentage was paid out to the employees as a year-end bonus. It was a great incentive not to be wasteful during the year, as you felt connected to the prosperity of the organization. It also made me very popular at the end of the year as I calculated and knew those results first. So walking to the rest room, for example, caused me to want wear a “NOT YET” sign, as in I don’t have the final, yearly results yet. In truth, it was all good, I didn’t mind, it made year-end exciting, even for me because while I had a good idea going into the closing of the books, I also didn’t know until the books actually closed.

What could happen if you started your own small business?

Could you change your course? Could you change the course of your family? Don’t think about it as getting rich, although people have. Think about it as learning to fish for yourself, always having a way to make at least a little money if no other job opportunities are available. Think about it as a way to have your next generation go into the world already knowing how to make honest money sooner rather than later. It doesn’t mean it has to be their career choice but they won’t starve ever and hopefully, they will always have health care available and not have to retire into poverty.

As it is now, we tend to rely on someone else to fish for us, “the company” and sooner or later, “the company” is likely to no longer need or perhaps even to desire our help to catch and share their fish. While we tend to learn much about the process and know that the skills we come to possess are needed, there are always others waiting to learn those valuable skills you are now expert in. So, go fish for yourself AND teach your family!

You say, “What would I do”. I say, “What do you know about that others already pay for or would pay for”. What do you love, that you would do for free? Is it business worthy? Alternatively, what do you find yourself wishing you had, or would pay for yourself, if you could? I’ve heard it said necessity is the mother of invention. I still wish I had invented sticky notes! RIGHT?

I think start with what you know, what you like, what you are good at, study, research, perfect it, hire / contract, partner with the expertise you need. Dot your I’s, cross your T’s, don’t half step but don’t reinvent the wheel either!

My mom use to have a saying about doing something half as…d, well you get the point. Don’t be that person and you can do this, many have before you. Remember 97% of all American businesses are small businesses. That means you and me. Why can’t it be You and Me?

I’ll leave you with one more of my Mom’s sayings –

“NOTHING BEATS A FAILURE BUT A TRY”

~Thanks for Reading~

AJaGi~ on Twitter

AJaGI~

DAVID BACH

DAVID BACH

by

by