Think Retirement Is A Long Way Off? Think Again

Three Resources to Help You!

(~ No Job Is Forever! ~)

If you’ve been following along lately, you will know that my most recent posts have been regarding success. Recently it occurred to me that a part of being successful is a comfortable retirement. No one wants or plans to retire into poverty. Not to mention the incredible drain such a situation creates for the family members who are most likely in the midst of weathering the course of mortgages and tuitions for their own immediate families. Also, to be considered is the tremendous drain on society such a situation creates.

Beyond the consideration of how it happens that so many people here spend their entire lives in poverty. This thought is especially highlighted when considering those who have spent their entire lives working and living a solidly middle (economic) class or better lifestyle, only to end up living the last of their years below the poverty line. We all know that life is just not fair at times. Yet, something seems very wrong with that picture to me.

I realize that hindsight is 20/20 and it is always easy to look from afar and to think one has hit the simple nail on the head as to how the other person misstepped along the way to cause their situation. (That’s the easy, therefore, we don’t have to think about it too much answer). While I’m sure there are plenty of errors or missteps to go around for all of us. I’m also certain that many would say that as they look back, they did all they could, at the time, just to stay afloat and still can’t see where they could have done anything more or different to have created a significantly better outcome for themselves. Nevertheless, we have to keep trying, don’t we?

Moreover, we must try harder to help the next generation, our children, nieces & nephews and others we come in contact with along our way, to at least hear the message that not only should they start earlier but that they can. Just maybe we can break this cycle.

Although I started working as a teen and saving in my twenties, I didn’t get serious about saving for retirement until sometime later. Now it wasn’t that I was blowing my money as much as I didn’t think I had any to spare and more importantly, thought I had plenty of time. I got it, I thought, but not really, because when you are 20something, you can’t really image how fast and short time can be all at the same time. While you are busy living and handling the day-to-day, one short-term plan at a time, it just flies by. Now, I wish that I had had a stronger understanding, sooner, of the importance of starting as early as possible but, of course, the world was different then. We still had defined benefit plans and social security. Our parents and grandparents retired with their corporate or government defined benefit pensions, which their employers had set aside for them over the course of their careers. All you really had to do, it would seem, was work hard, earn a decent living, retire, and then collect your well-earned benefit checks. And life is good. Right?

However, the current day average stay with an employer is only four years and we all now have some version of a defined contribution plan (401K) while the pension plans of yesteryear have all but gone by the wayside.

So, what to do ~ Where to start, When to start, How to start.

(The following resources are offered to assist you:)

(1)

FINANCIAL AUTHOR DAVID BACH

DAVID BACH

DAVID BACH

Author of the Automatic Millionaire and many other must reads regarding your financial health.

When I first read David Bach (I’ve also enjoyed hearing him speak live), it wasn’t so much that he offered much I didn’t already know, as it was that he sorts through it and lays it all out in a neat, simplistic, easy to follow manner. In his presentation, he helps us to see things differently, from another vantage point, a perspective where things are more clearly doable. An example of this, I think, is what he calls the “Latte Factor”.

Please read his description but — it basically says, hey, if you are looking for money in your budget, but believe that you are already tapped out, consider how often you stop by the coffee shop during the week for a latte. If you cut back on just one a week, you would have approximately $20.00 more a month to pay off a debt, build a raining day fund, save for retirement, etc.

That’s what I meant by, not necessarily new, but a different perspective to help us to see possibilities that didn’t seem to be there before. I already do something similar. I’ve been known to say, “I tend to think in terms of what it will cost me.” I’ve done this for my time and my money so as to squeeze something in without increasing my monthly budget. However, I had only ever considered this for short-term goals. In this case, the cost is 4 cups of coffee per month. Are you really going to miss one coffee a week? Probably not.

DID YOU KNOW – That it is possible to borrow the down payment for your home, from yourself, without penalty?

Many great minds out there write and speak on this subject. However, I like David Bach’s presentation and easy reading layouts. He not only tells us the what but also offers a plan of action to follow.

(2)

RETIREMENT CALCULATION EXAMPLES

The following example is based on our premise of only $20 a month. So, let’s see what a simple $20 / month could get us.

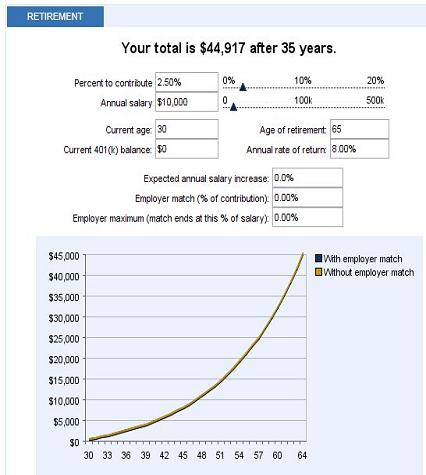

Example 1: $44,917

Assumes a $21/month contribution ~ starting at AGE 30 ~ 8% rate of return ~ NO employer (ER) matching contribution.

- $67,527 – When started at AGE 25

- $100,748 – When started at AGE 20

SOURCE: Find interactive calculator at www.Bankrate.com

While we may start out with a $20 / month contribution, it is reasonable to expect that our contributions will increase over the years as our personal income increases.

The next example assumes more personal income and, therefore, a larger monthly retirement contribution. Additionally, this example includes an employer (ER) matching contribution since many employers now offer this benefit.

Example 2: $2,095,882

The following calculation assumes an annual salary of $40,000 with a 10% (approx. $333) monthly retirement contribution ~ starting at AGE 20 ~ 8% rate of return and a 50% ER match.

- $1,404,771 – When started at AGE 25

- $934,412 – When started at AGE 30

Also, notice (on graph) accumulation amounts without the ER matching contribution. Or, pop over to the www.Bankrate.com site and create your own calculations!

So, squeeze / reallocate $20 a month from your current budget and sign up for a 401k plan at work or open you own. Then contribute, via a pre-tax payroll deduction or an automatic deduction from your bank account and take the tax deduction at the end of the year. Whenever you get a raise, increase your contribution a bit and watch your account balance grow over the years.

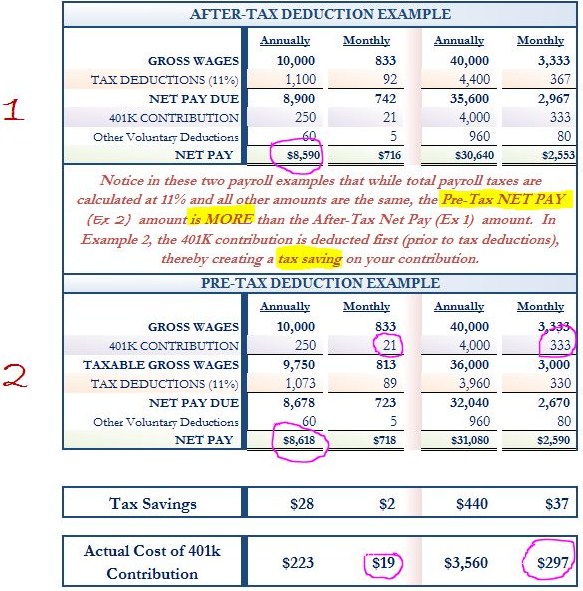

How do you get a $21 contribution with only $19 or a $333 contribution with only $297, for example?

– Take a look at the following:

Pre-Tax / After-Tax Examples

If you are joining your firm’s 401K plan, be sure to do everything you can to contribute (to your plan – to yourself), at least, what your employer will match. If you don’t take advantage of this, it is the same as saying no to free money. Now, how often does that happen! So cut out a coffee a week or brown bag it one day a week. Heck, make it two coffees, if need be. You will thank yourself later!

(3)

SIX MAJOR TYPES OF RETIREMENT ACCOUNTS

REBLOG:

Plan to Retire Someday? You’ll Want One of These – Daily Worth

Excerpt:

“You’re not alone … if you get tripped up by all the retirement gobbledygook. Here’s our straight-up guide to the six major types of retirement accounts.”

~ Susan Gregory Thomas ~

(read article here)

I hope that you found this information useful and that you will be encouraged and will encourage others to start now! No matter when your “now” is. Always better late than never.

~AJaGi~

~Thanks for Reading ~

==================================

“Recession is when a neighbor loses his job. Depression is when you lose yours.”

~Ronald Reagan~

by

by